Stripe vs PayPal In-Depth Comparison

Learn everything you need to know in our Stripe vs PayPal comparison. Stripe and PayPal are two payment processing systems – or payment gateways as some call them – that have become highly popular over the years. With Stripe and PayPal, individuals and business owners can carry out online transactions easily.

PayPal (founded in 1998) and Stripe (2011) both come with a ton of features, though differing in a lot of ways. So, which payment gateway should you choose? Truth is, deciding which platform to choose will depend on a number of factors.

In this article, we will be closely comparing the two systems to know which would make a good fit for you. Our comparison will not be based on cost alone – we shall consider security, customer support and a host of other features.

In the end, it will be entirely up to you to decide which to go for.

But before we begin comparing both systems, we will first determine the possibility of using both at a time.

In this article:

- Can I use PayPal and Stripe at the same time?

- Stripe vs PayPal: an in-depth comparison

- Final Verdict

- Other Online Payment Processors

- Conclusion

Can I use PayPal and Stripe at the Same Time?

The short answer is yes – both PayPal and Stripe can be used at the same time. Integrating both systems will help if you operate your business in different countries. PayPal, for instance, places restrictions and limitations on users in some countries. Such limitations may hurt your business.

The problem, however, with having both payment options is managing the complexity of maintaining them. You would have to deal with multiple vendors, maintain a slew of developers, etc. So, unless you have the budget and time to keep both, it’s best to stick with one.

Stripe vs PayPal: an in-depth comparison

In this section, we shall be comparing these two payment processing systems based on a number of important factors, starting with one of the most important – cost!

Cost and Transaction Fees

Both Stripe and PayPal have zero start-up fee – you don’t have to pay any upfront fee to join. Also, both platforms have zero monthly subscription fees, with the exception of PayPal Pro. You only get charged for transactions. This method has proven successful for attracting merchants, especially small business owners.

Let’s compare both payment gateways – transaction fee wise – side by side.

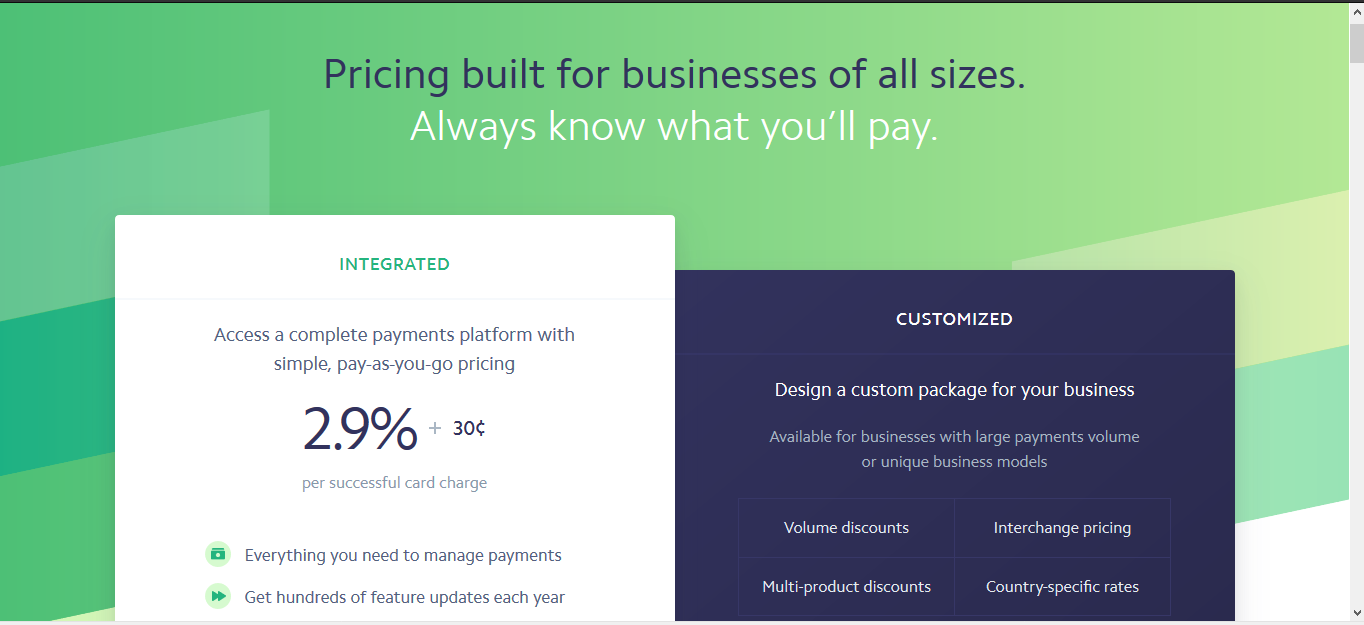

Stripe: transaction fee

As earlier said, Stripe does not charge a monthly fee. But for micropayments, they charge 2.9% for every $1 plus 30 cents transaction fee.

For every $1 transaction, you’d pay: 2.9¢ + 30¢ = 32.9¢

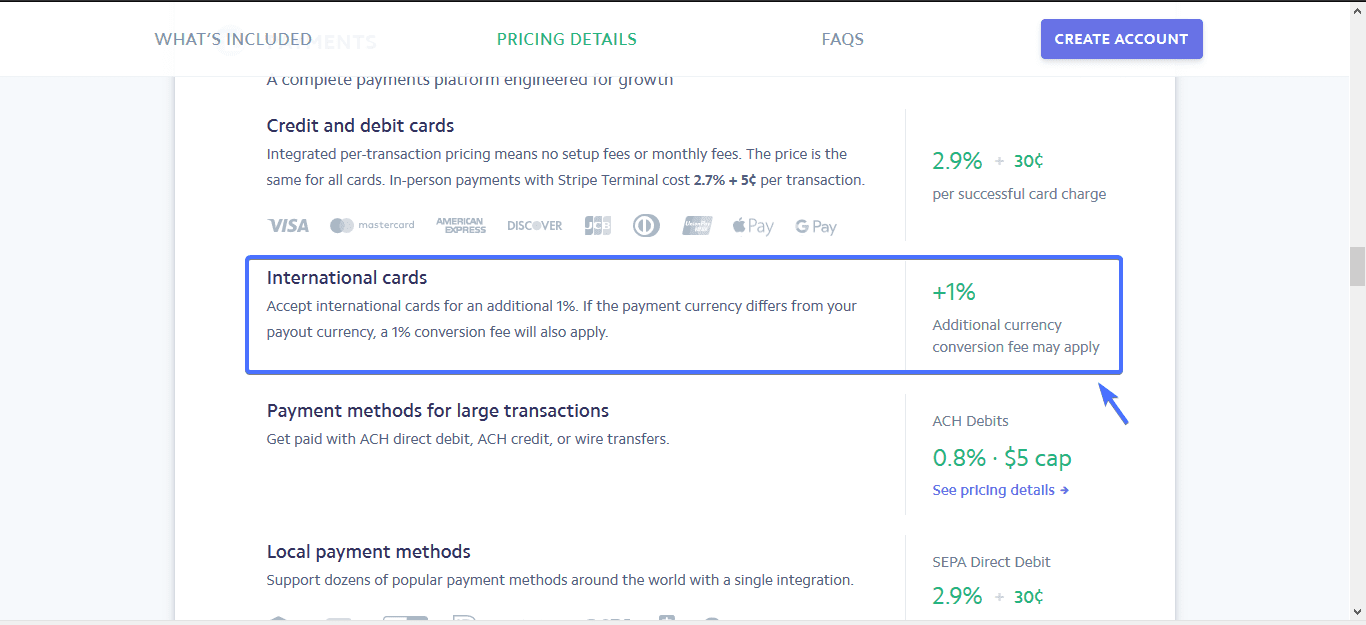

This transaction fee is applicable to customers within the United States. However, transactions outside the United States – for Stripe – attracts an additional 1% fee.

That is: 2.9% + 1% + 30¢ = 3.9% + 30¢

Stripe: chargeback fee

Chargebacks are a headache every merchant would want to avoid. But unfortunately, they are unavoidable. Chargebacks are fees drawn against you in the event of a payment dispute between you the merchant, and the cardholder.

For Stripe, the chargeback fee is $15. If, after investigation, the dispute swings in your favor, Stripe would reimburse you the deducted fee.

PayPal: transaction fee

PayPal transaction fee structure, though quite similar to Stripe, varies in lots of ways. Here’s a breakdown of the transaction fees for PayPal:

- Transactions from $10 and below: 5% for every $1 + 5¢

- Payments above $10: 2.9% for every $1 + 30¢. For example, a $20 transaction will attract 2.9% of $20 + 30¢ = 58¢ + 30¢ = 88¢ fee.

- International transactions (transactions outside the United States): 4.4% for every $1 + PayPal’s fixed fee. This fixed fee varies from country to country.

- For charity organizations, PayPal charges 2.2% for every $1 + 30¢

PayPal: chargeback fee

PayPal’s chargeback fee stands at $20. Just like Stripe, PayPal would pay this fee back into your account if the dispute ends in your favor.

Winner: Stripe

Clearly, Stripe comes out on top in the tussle for the most cost-effective platform. Stripe’s transaction fee and chargebacks are lower than that of PayPal.

Stripe vs PayPal: Customer Support

Any business that fails to provide 24/7 support to their customers cannot compete in this age. Stripe and PayPal both know this, and they both offer good customer service. Let’s line up their customer support and see which would win

Stripe

This payment service commenced 24/7 customer support sometime in July 2018. Up until then, getting help from their support team was quite a difficult task. All that is gone now.

Stripe now offers support over the phone, via live chat and email. It’s entirely up to you to decide which would be the best fit. Their phone lines are toll-free, but can only be accessed by registered users. Even more, they have robust documentation you can consult before reaching out to them.

PayPal

Paypal takes things a little bit further by adding a community forum, in addition to what Stripe has already.

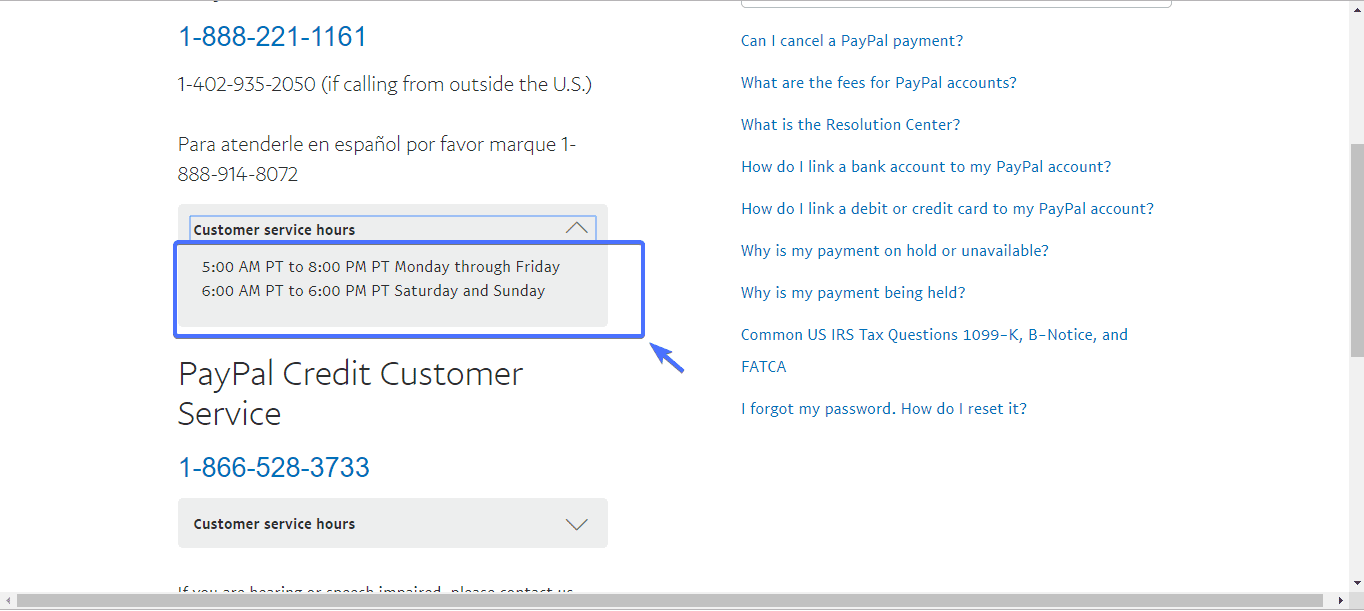

Unlike Stripe, PayPal’s phone support is limited, and can only be accessed at specific periods during the day. The opening and closing hours of their phone support is shown below:

So, you might not get phone support with PayPal at every instance of the day. If you like hanging around forums be sure to check out PayPal community.

Winner: Stripe

Ordinarily, this would have been a tie, but considering Stripe offers toll-free, 24/7 phone support, we give it up to them. Stripe wins!

Security

With internet fraud on the rise, the importance of secured online transaction can’t be over-emphasized. If users can’t guarantee that their credit card details are in safe hands, they will have a hard time purchasing from you. So, let’s see how PayPal and Stripe line in terms of security.

Stripe

Stripe has an inbuilt two-factor authentication technology, which tightens up security on your website. In addition to that, Stripe is strictly PCI (Payment Card Industry) compliant, which is the standard for e-commerce security. PCI bothers itself with how your customer’s card details are handled.

Now, you may choose to handle all PCI compliance issues (including your customer’s data). Not only would this prove cost intensive, you run the risk of a data breach. So, it’s best to let a third party handle all PCI compliance issues. Luckily, Stripe does the heavy lifting for you, if you let them.

PayPal

PayPal, in a similar manner, offers PCI compliance support across all its platforms. The only exception to this is PayPal payments pro where merchants are required to set up their PCI parameters.

Winner: Tie

There is no clear-cut winner between Stripe and PayPal as far as security is concerned. They are both very secure payment platforms.

Global Presence and Currency Support

Business expansion may warrant you establishing operations in several other countries. As such, it makes business sense to take into account the global presence of PayPal and Stripe.

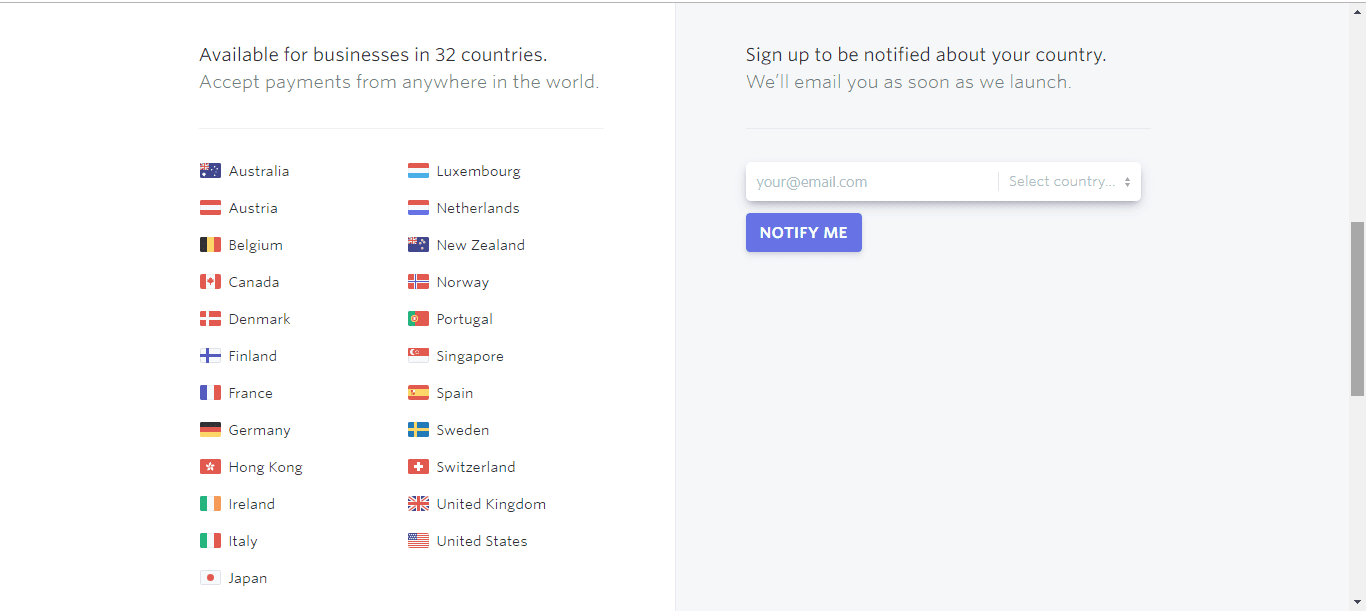

Stripe

Stripe accepts payment from 32 countries of the world. If your country isn’t included in the list, don’t panic yet. With Stripe Atlas – created for merchants outside countries where Stripe is present – you can work your way around this limitation. Stripe Atlas lets you incorporate a company in the US, set up a bank account, and accept payment via Stripe.

Ironically, Stripe supports over 135 currencies. That’s a whole lot of options!

PayPal

With a presence in over 200 countries, PayPal clearly beats Stripe in global reach. So, if Stripe isn’t in your country – and incorporating a company in the US looks like so much work – try PayPal.

Surprisingly, PayPal only supports 25 currencies, in sharp contrast to Stripe which supports over a hundred.

Winner: Paypal

Paypal supports 168+ more countries than Stripe does. That’s a serious margin.

Ease of Use

Ease of use and user experience are two major factors to the success of any app – mobile or web. The user experience of these two platforms is nothing short of excellent, no doubt. Let’s match them up to see which has better ease of use

Stripe

Stripe, as it were, was created with developers in mind. Of course, you don’t have to be a badass developer to integrate Stripe. You should at least know how to read codes and make tweaks when needed.

To this end, if you aren’t tech savvy or your coding skills are rusty, Stripe might be a bad idea. The only upside to this is that you can customize Stripe’s checkout in multiple ways. That is if you know how to write codes.

However, if you are using a CMS platform like WordPress, there are several plugins with all the code already written for you. Integrating Stripe thus becomes a super simple, copy here, paste there process.

PayPal

PayPal knows fully well that most of its users are merchants who aren’t really interested in the behind-scenes. Marketers, sellers, bloggers etc. are their demographics, and this set of people know little to nothing about coding.

So, if you are bent on staying away from anything that would make you write code, go for PayPal.

Winner: PayPal

PayPal offers a beginner friendly platform.

Stripe vs Paypal – Third Party Integration

The success of your online business will, to some extent, depend on the e-commerce platform, CRM, and accounting software you chose. Let’s see how Stripe and PayPal integrate these third-party extensions.

Stripe

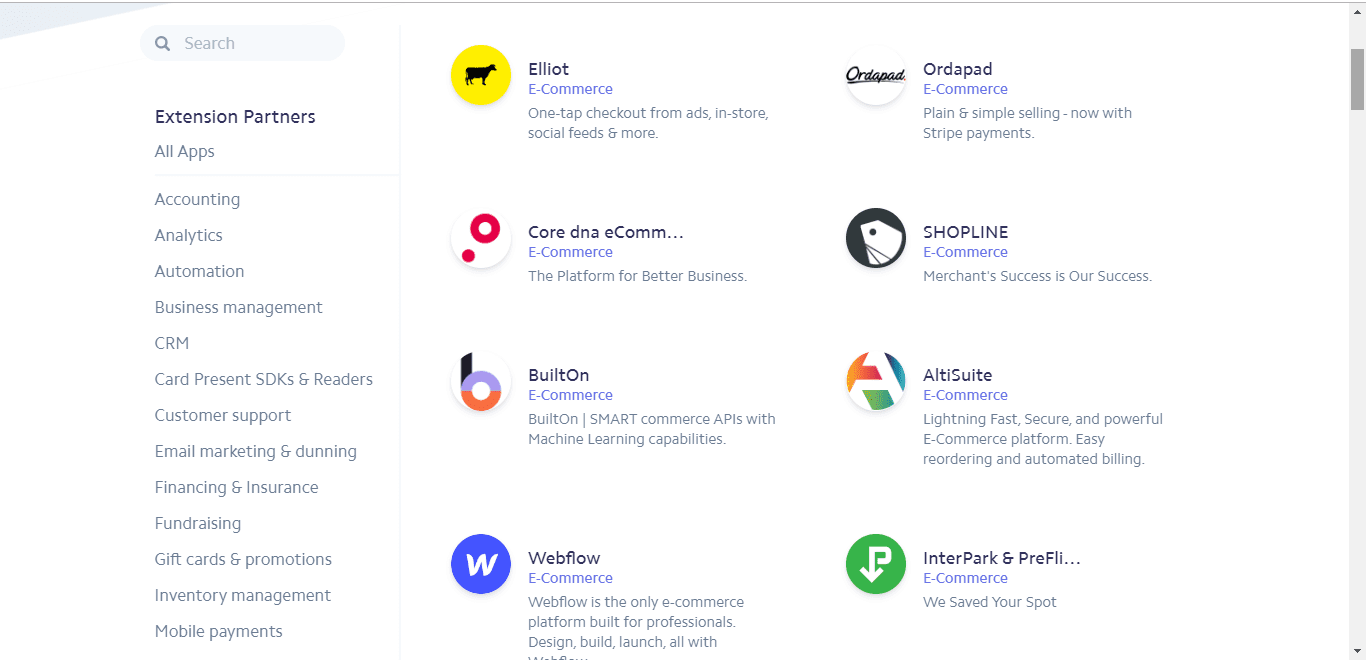

Stripe has really raised the bar when it comes to third-party integration. From the popular WooCommerce to the most recent e-commerce platforms, Stripe integrates all of it. They have a huge list of categories of supported extensions to make finding and integrating features easy.

So, whatever software or e-commerce platform, accounting or project management software you chose, Stripe has got you covered.

PayPal

Though PayPal really did a good job in integrating as many third-party extensions as possible, it’s nothing close to Stripe’s. PayPal mostly integrates well-established technologies, and so might miss out on your preferred CRM software.

Winner: Stripe

The trophy goes to Stripe in the integration comparison.

Checkout Experience

It is in your best interest to make your online business checkout process short and direct. The reason is simple: the average attention span for a web user is really low. So, it’s imperative to give your users the best checkout experience.

You sure don’t want them abandoning their carts halfway through making a purchase. Research shows users will most likely abandon their shopping cart if they are obliged to take several actions before making an actual purchase. Simplicity is key here.

Stripe

Stripe’s checkout process is really stunning. First, it’s highly customizable, giving you total control over your business’ checkout process. You can change elements, place them where you desire, alter colors etc. In fact, you can build your own checkout page.

Second, to make payment via Stripe, all that is required of users is their credit/debit card details. No extra bulky process.

Best of all, Stripes supports apple pay and is localized in about 14 languages. So language can’t be a barrier to your checkout process.

PayPal

PayPal really put in the effort to make its check out process simple and short. Customers can elect to pay with their credit/debit card or via their PayPal account.

The only drawback, however, is that customers are made to complete their checkout in a new window. This likely increases the chances of a customer abandoning their cart.

Winner: Stripe

Once again Stripe clinches the trophy, looking at the simplicity of their checkout process.

Stripe vs Paypal – Virtual Terminal

When you make a purchase at a store by swiping your card, the device you swipe your card on is referred to a terminal. Like in the conventional brick-and-mortar store, terminals are also used in online stores. Of course virtually, hence the name virtual terminal.

Virtual terminals make it possible to accept payments from customers just about anywhere without the need for a card swipe. Perfect solution if you process orders and payments over the phone or fax. Additionally, customers that are scared of making payments online will find virtual terminal welcoming.

Both PayPal and Stripe have virtual terminals, though with different setups.

Stripe

Stripe has a virtual terminal, though still in beta version. This means the features aren’t fully developed yet, and usage is limited. Since it isn’t well developed yet, we will not encourage you to use this feature on a live store until a stable version is available.

PayPal

PayPal has a fully developed, functional virtual terminal. It lets you process orders over the phone, face-to-face meeting, etc. And that’s not all; customers that don’t have a PayPal account can make payments via PayPal terminal.

PayPal terminal is quite easy to set up, and needs no coding on your part. You can accept multiple payments simultaneously via PayPal virtual terminal.

But there’s a catch to PayPal’s virtual terminal: you are billed $30 per month, whether you make a sale or not. Also, PayPal’s sellers’ protection policy doesn’t extend to its virtual terminal users.

Winner: PayPal

PayPal’s virtual terminal obviously dwarfs that of Stripes’. If a virtual terminal fits your business well, we recommend you sign up for a PayPal account.

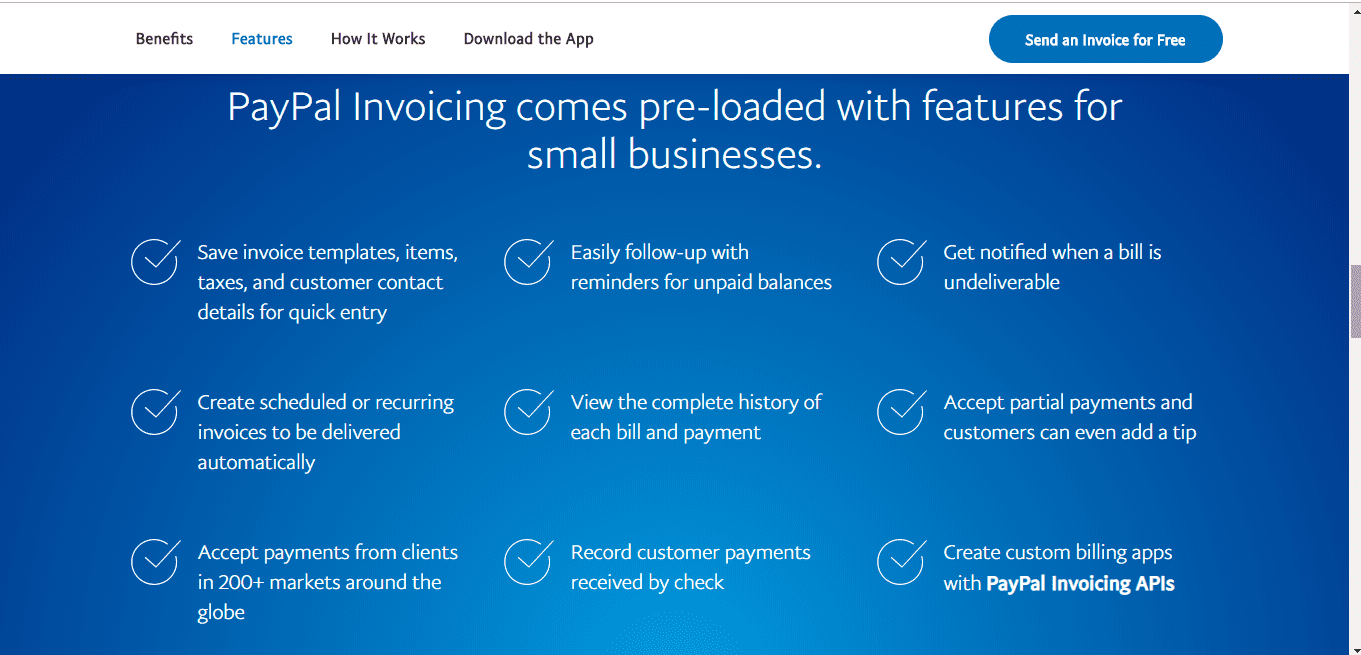

Stripe vs Paypal – Invoicing

If you are a freelancer, for instance, your client will most likely not pay you until you have raised an invoice. This also extends to consultants and service providers. As such, you need a payment platform with an effective invoicing solution.

You may choose to use an accounting software for invoicing, but that won’t be necessary. Both PayPal and Stripe are equal to the task.

Stripe

With Stripe, you can create elegant looking invoices, customized to your taste. You can add a logo, insert a thank-you message and set a language. That’s not all, Stripes’ invoicing solution lets you set reminders for clients and also include taxes to your invoices.

If you are looking to invoice multiple customers at a single go, you may have to look elsewhere beyond Stripe. Everything else works fine.

PayPal

Like Stripe, PayPal allows you to customize your invoices, though to a limited degree. If nothing else, you can add a custom logo to your invoice. Unlike Stripe, PayPal allows you to bill multiple customers at the same time, without any additional cost or monthly fees. Plus you can attach additional files alongside the invoice.

Winner: PayPal

Though Stipe is more aesthetically customizable, PayPal offers more core functions, chief of which is the ability to invoice multiple clients.

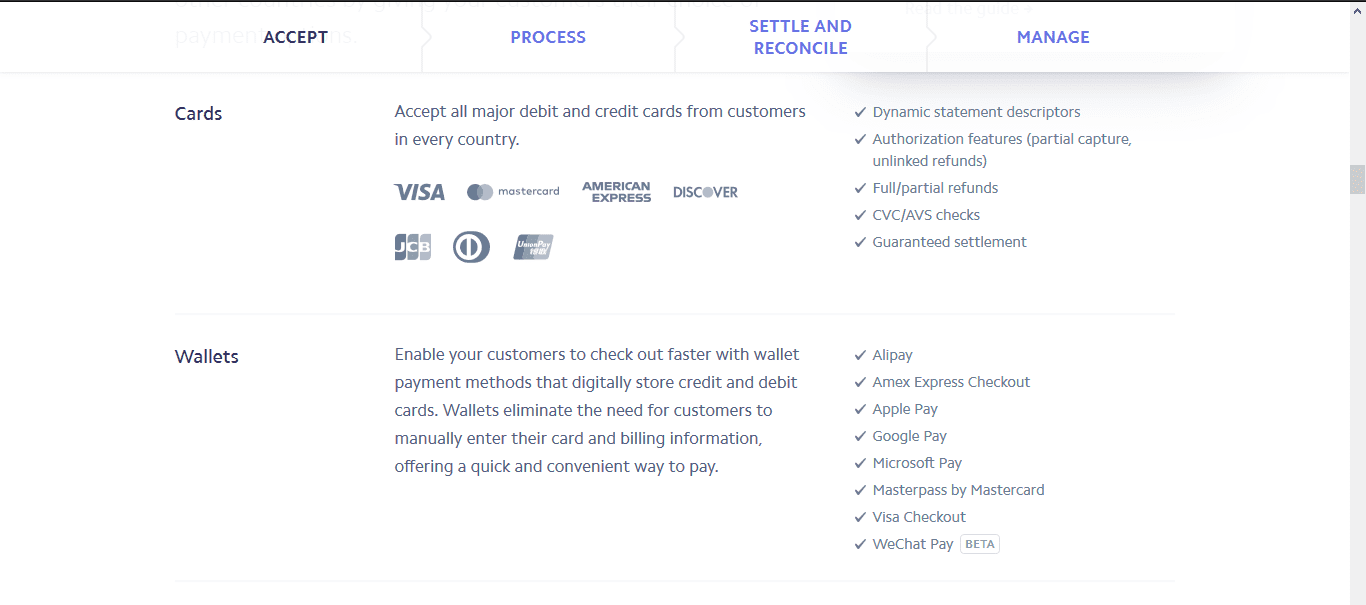

PayPal vs Stripe Payment Options

It’s really important, in the interest of your business, not to shut any customer due to their payment choice. You need a payment solution that is big enough to accommodate just about anybody. They both have robust payment options, though with slight variations.

Stripe

Stripe accepts credit/debit card payment from literally all major card payment solution providers. This includes Visa, MasterCard, American Express, to name but a few. Even more, it is compatible with several wallets in the market.

They also have a local payment solution, compatible with ACH Credit transfer, Alipay, Giropay etc. Your customers can’t run out of options with Stripe.

PayPal

Just like Stripe, PayPal accepts payment from major card networks. And your customers need not have a PayPal account.

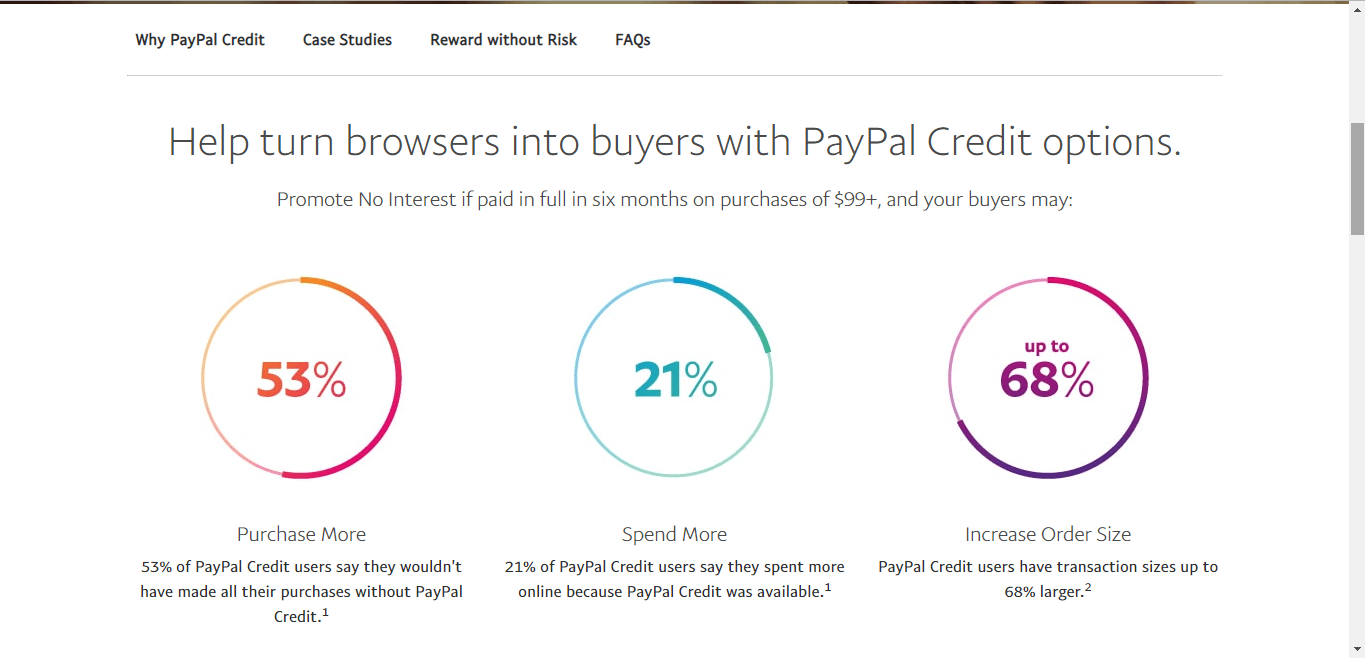

In addition to card payments, customers can also make purchases via PayPal Credit. This is a new financing solution which lets customers buy and then pay later.

Customers that pay via PayPal credit won’t be charged interest, so long they pay up within 6 months and their order is above $99. You, as the merchant, gets instantly paid – it’s left for PayPal to follow up on the credit.

Winner: Tie

We have a tie here. Though Stripe beats PayPal to the number of payment options, PayPal credit evens out the imbalance. In the end, it boils down to what matters most to your business.

Paypal vs Stripe – Final verdict

It was quite an interesting matchup, wasn’t it? Though Stripe seems to have swooped most of the title, the truth is, it’s a win-win situation.

So which should you go for? Go for Stripe if you are:

- Not scared of code, or have someone who understands coding and API integration. Or if you are using a CMS platform like WordPress which already has its integration plugins.

- A person who likes things customized. They have plenty of legroom for customization.

- Want to integrate third-party services to your payment solution for added functionalities.

You can bet on PayPal if you are:

- Don’t want to deal with much code.

- Looking to piggyback on the popularity of a payment platform. PayPal is way more popular than Stripe – Stripe is just a new kid on the block.

- Fine with accepting payments without much need for customization.

- Looking to expand your business internationally.

Other Online Payment Processors

Though we only considered Stripe and PayPal in this article, there is a whole slew of others out there. In countries where both are not present, these other platforms might become handy.

They include:

Stripe vs Paypal – Conclusion

The success of your online business will very much depend on your choice of online payment processor. You need a solution that is simple to use for your customers, accommodating enough to accept different payment options, and fully functional.

Stripe and PayPal, being the two major giants, are really worth considering. To make it easy for you to decide which to choose, we have compared them, carefully analyzing their strengths and weaknesses. Remember, you can always test and re-test until you find which best meets your needs.

If you found this article helpful, do share.